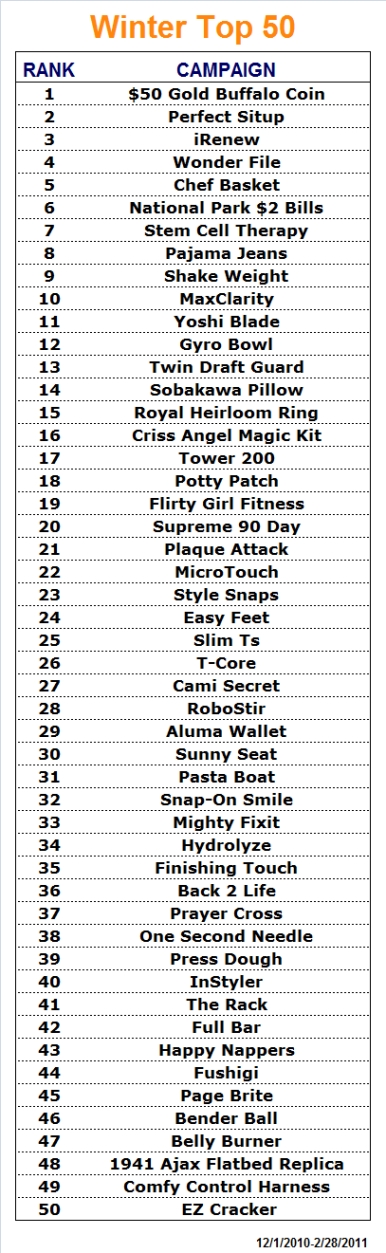

As promised, here is an analysis of my recently published Winter True Top 50, which covers the beginning of December 2010 through the end of February:

Quite a few new hits have emerged. They are:

No. 12: Gyro Bowl (Media Enterprises/Hutton-Miller). A testament to the power of "wow factor." I hear big claims about this campaign on TV, and sources say retailers are clamoring for it. Although I never reviewed it (inside info), I did critique it early on, and my thoughts remain the same: Awesome product, but the market is limited to parents of toddlers (like me). So there will be a cap on how far this item can go relative to more mass-market items. Still, the TV results suprised me, so maybe this is one of those items that captures 100% of a niche market and, as a result, delivers mass-market level sales.

No. 15: Royal Heirloom Ring (Telebrands). I declined to make a prediction in my review of this one because this is not my area of expertise, but I was favorable toward it and understand why it was successful. However, I will make a prediction now: All who follow with similar memorabilia will fail.

No. 20: Supreme 90 Day (Telebrands). I missed this one until it was too late. But given the sucess of Beach Body's P90X, it would have been an easy call.

No. 23: Style Snaps (Allstar-Merchant Media/Hutton-Miller). I reviewed it, and I was wrong. In my defense, I was misled by inside info on a similar product that tested and failed. I also hedged a bit, declaring: "I can see this selling well in other channels." So I wasn't dead wrong. That counts for something, right?

No. 24: Easy Feet (IdeaVillage-Zoom TV Products). I reviewed it, and I was right.

No. 26: T-Core (Fitness IQ). I completely missed this one, which comes from the company that brought you Shake Weight (No. 9). Another example of how the criteria are different for men's short-form fitness.

No. 28: RoboStir (Telebrands/Sullivan). I reviewed it in Response, and I was right. However, the item required a new pricing strategy and new marketer for my prediction to come true.

No. 29: Aluma Wallet (Telebrands/Sullivan). I reviewed it, and I was wrong. Dead wrong. And watching the commercial again, I get it. Kudos to the Telebrads/Sullivan team for figuring out how to sell women a wallet when so many others have failed at the same task.

No. 30: Sunny Seat. I reviewed it, and I was wrong -- maybe. I tend to doubt it. Something is fishy here. I predict it disappears by the time I post my spring chart.

No. 38: One Second Needle (Telebrands/Sullivan). I reviewed it in Response magazine and predicted failure. I guess I was wrong. The problem: I still don't know why. I can't imagine why anyone would buy this product and would love to hear the reasons from a few people who have (not marketers and not "theorists," since anyone can rationalize a hit after the fact).

No. 39: Press Dough (Little Kids/Hutton-Miller). I don't usually review kids' products, so I skipped this one. Nothing to say, really. I get it.

No. 41: The Rack. I reviewed it, and I was right. Still wondering about those shipping costs, though, and customer satisfaction with the price.

No. 43: Happy Nappers (Jay at Play/Hutton-Miller). I reviewed it, but I didn't make a prediction.

No. 44: Fushigi (IdeaVillage-Zoom TV Products). The name of this product means "mystery," and it's still a mystery to me why anyone bought it. I mean, I get why kids would want it after watching the commercial. But keep it? Use it? I'll bet it's sitting in a lot of closets gathering dust. Needless to say, my review wasn't favorable, and I was wrong again.

No. 49: Comfy Control Harness. I reviewed it, and I was wrong again. I have to believe this is more of a retail play because I don't believe enough people are buying off TV for this to be profitable. Of course, I could very well be wrong.

I didn't cover the

$50 Gold Buffalo Coin (No. 1) or the

Ajax Flatbed (No. 48) because coins and collectibles are way outside my area of expertise.

For those who like to keep score, that makes my winter track record a paltry 33 percent (or 1 in 3 predicted correctly). What's going on? Am I losing my touch? Or were people pushing mediocre items because of the holidays, followed by that great January media, and a lack of bigger hits? Or both? I report; you decide.

In other news,

Telebrands and IdeaVillage tied for the "true top marketer" of the winter, each with eight hits in the Top 50.

Telebrands had Chef Basket (5), Royal Heirloom Ring (15), Supreme 90 Day (20), RoboStir (28), Aluma Wallet (29), Pasta Boat (31), One Second Needle (38) and Comfy Control Harness (49).

IdeaVillage had Yoshi Blade (11), Criss Angel Magic Kit (16), MicroTouch (22), Easy Feet (24), Slim Ts (25), Finishing Touch (35), Prayer Cross (37) and Fushigi (44).

If I had to declare one the winner, I would say it's Telebrands because they had one in the Top 10 (Chef Basket) and three in the top 20, while IdeaVillage had none in the Top 10 and two in the Top 20. But it's a close call.

Meanwhile,

Hutton-Miller earns "true top producer" of the winter honors with seven hits in the Top 50. They were iRenew (3), Gyro Bowl (12), Style Snaps (23), Mighty Fixit (33), Press Dough (39, Happy Nappers (43) and Page Brite (45). Blue Moon was a close second with six hits in the Top 50.