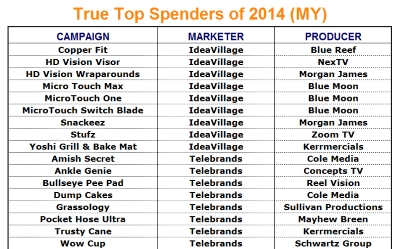

Charts of hits such as my mid-year True Top Spenders raise inevitable questions. Most are of the sour grapes variety, but one particular question is always worth pondering: Where do the top marketers get their hits?

One might assume the answer to that question is a closely guarded secret, and that every top DRTV company has at least one covert source of inside sales information. But what if the truth is that outside sources are more likely to be responsible for a top marketer’s hits these days?

For instance, if I eliminated 'follower items' (my new euphemism) from the chart , the number of hits for the True Top Marketers of recent years would look like this:

- IdeaVillage: 6 (down from 9)

- Telebrands: 5 (down from 8)

- Allstar: 3 (no reduction)

IdeaVillage stills gets the top spot, and Telebrands is still just one campaign behind, but Allstar's placement no longer looks so distant. IdeaVillage loses three because of Copper Fit (Tommie Copper was first), HD Vision Visor (Easy View was first) and Yoshi Grill & Bake Mat (Miracle Grill Mat was first). Telebrands also loses three because of Amish Secret (Dutch Glow was first), Grassology (Cutting Edge was first) and Trusty Cane (HurryCane was first). Allstar doesn't play this particular game, so they don't lose any.

To make this even more interesting, let's also eliminate campaigns that have appeared on previous charts so that we are only evaluating 2014 rollouts. Now the list looks like this:

- IdeaVillage: 4 (down by 2)

- Telebrands: 4 (down by one)

- Allstar: 3 (still no reduction)

IdeaVillage loses MicroTouch Max and HD Vision Wraparounds, and Telebrands loses Pocket Hose Ultra. That last one isn't perfectly fair since a 'pro' product is technically 'new,' but it serves my purposes here. In any case, now IdeaVillage and Telebrands tie for first, and Allstar is a strong second.

Now a final question: How many of the remaining 11 hits are from 'inside'? In other words, if we eliminate every (new) campaign from my True Top Spenders that wasn't discovered by the listed marketer, how good do the top dogs look?

I ask because it is common to assume the companies that top a chart have exhibited a talent for identifying hits. But as I will now demonstrate, that isn't necessarily true. Indeed, the greatest talent for picking winners may reside outside of the big companies these days -- a fascinating trend.

Here's the list again, this time minus the ones I know came from outside:

- IdeaVillage: 2 (down by another 2)

- Telebrands: ?

- Allstar: 1 (down by 2)

I don't know enough about Telebrands' four campaigns to make this a complete list, but I do know enough about the other seven campaigns to make my point. IdeaVillage loses MicroTouch One, which came from 221 Direct, and Stufz, which came from Zoom TV. Allstar loses Perfect Bacon Bowl, which came from Edison Nation, and Secret Extensions.

I can go on. Emson's campaigns are a mystery to me, but I know Hampton has one old campaign on the list (Chillow) and one from Lenfest (My Spy Birdhouse), which would net them out at one. Even the guys with two on the chart aren't safe: Both Phil Swift and Norman Direct lose one if old items are excluded (Flex Seal and Mr. Lid, respectively). And Mr. Swift would have nothing left if I were as strict with Flex Shot as I was with Pocket Hose Ultra: That brand is well beyond 'pro.'

In the end, it seems the brilliance needed to pick winners is pretty evenly distributed in our industry with no significant difference between a large, veteran firm and a small, emerging one. So in the end, IdeaVillage ties with Infomercials Inc., each with two good picks apiece ... and everyone else is a close second with one.