I'm still having fun with Google Insights for Search. Today, I used it to better understand the life cycle of DRTV campaigns when measured in consumer interest online. More on that later.

First, I have to add a few caveats to my first post. (A big thanks to everyone who took the time to think about this new methodology and point out its pros and cons.) There are a few worth mentioning ...

One thing that quickly became clear (HT: Bob G.) is that items with an age skew will be over-represented or under-represented by this tool. That is, if we are to use this tool as a guage of DRTV success, we need to be careful about items that skew toward seniors (who are less likely to buy online than average) and items that skew toward teens and twenty-somethings (who are more likely to buy online). This may help explain the big gap between Emson' Micro Plus (a "3" on the graph) and Allstar's Trendy Top (a "40" on the graph). Having managed both Listen Up and Loud 'N Clear, I know hearing assistance devices skew much older than average. Meanwhile, the media mix for Trendy Top makes it clear that product skews younger than average.

Another thing I learned is that the Google tool does NOT present average searches per day, as I previously thought (HT: Josh A.). Instead, it presents indexed results that are scaled and normalized. As Google explains: "The numbers on the graph reflect how many searches have been done for a particular term relative to the total number of searches done on Google over time. They don't represent absolute search volume numbers because the data is normalized and presented on a scale from 0-100." Using the previous example, then, it isn't accurate to say Trendy Top had an average of 40 searches per day during the last month. Rather, its search volume was a 40 on a 100-point scale for the parameters set.

Despite these caveats, the Insights for Search tool is still immensely useful. Most campaigns don't skew older or younger in a way that would distort results significantly: They fall within the general age range for DRTV projects. Likewise, whether the numbers on the graph represent absolute searches or scaled-and-normalized searches doesn't matter much if we are comparing and contrasting DRTV trademarks using the same parameters. It also doesn't matter when we are doing other cool things, such as tracking consumer interest in a product over time.

Take, for example, two campaigns that launched one year ago this month and rolled out. According to what I reviewed in February 2011, two good choices are Telebrands' Slim Away and Allstar's Perfect Meatloaf. Let's look at the life cycle of these products, relative to each other, in terms of consumer interest online:

Here we see a typical campaign and an atypical one. Both spike predictably around the beginning of Q3 (when lower media rates lead to spending ramp-ups) and the holiday season. But Slim Away's general trend line is upward, which is unusual.

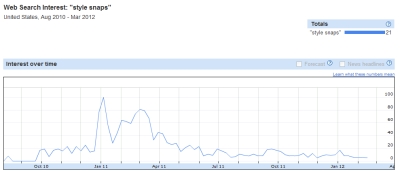

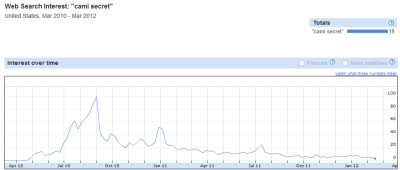

What about the rule of thumb that says the life cycle of a DRTV product is 18-24 months? To test that, let's take a campaign that is 18 months old and one that is 24 months old. A good choice for the former would be Style Snaps, which I reviewed in August of 2010. A good choice for the latter would be Cami Secret, which I reviewed in March of 2010.

Here's Style Snaps:

And here's Cami Secret:

As you can see, the bulk of interest was within a six-month window. After that, the campaigns bumped along -- but it would be hard to say they had 'life' relative to peak interest.

February 20, 2012

More Insights

Posted by

Jordan Pine

at

12:40 PM

![]()